tax on forex trading nz

Forex Trading NZ - Best Forex Brokers Regulation Taxes In this. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

Forex Trading Nz Best Forex Brokers Regulation Taxes

Where you are trading with the intention of selling for a profit in a short space of time gains will be taxable.

. Jake decides to sell 115000 of cryptocurrency for NZ dollars to a NZ based purchaser. Three years ago I attended a remarkable seminar. Spot forex traders are considered 988 traders and can deduct.

Profitable trading bot reviewed. May 14 2014 433am May 14 2014 433am. Greater than Rs 10 Lakh.

People trade in forex either to try to make a quick profit by betting on the changing value of a currency or to provide certainty about the cost of future foreign currency payments called hedgingThe risk of online foreign exchange trading is high. Are those countries tax free as well. How much time and effort you put into buying selling or exchanging cryptoassets.

New Zealand boasts a relatively strong economy free from the financial turmoil in the West. Aspiring forex traders should consider tax implications before getting started on trading. Hi I am planning to trade in NZX ASX AND FOREX MARKET.

Suggest keeping good records of trades in a separate bank account which will make tax time lots easier. No capital gains tax at all in NZ. Ad Read before you buy a trading bot.

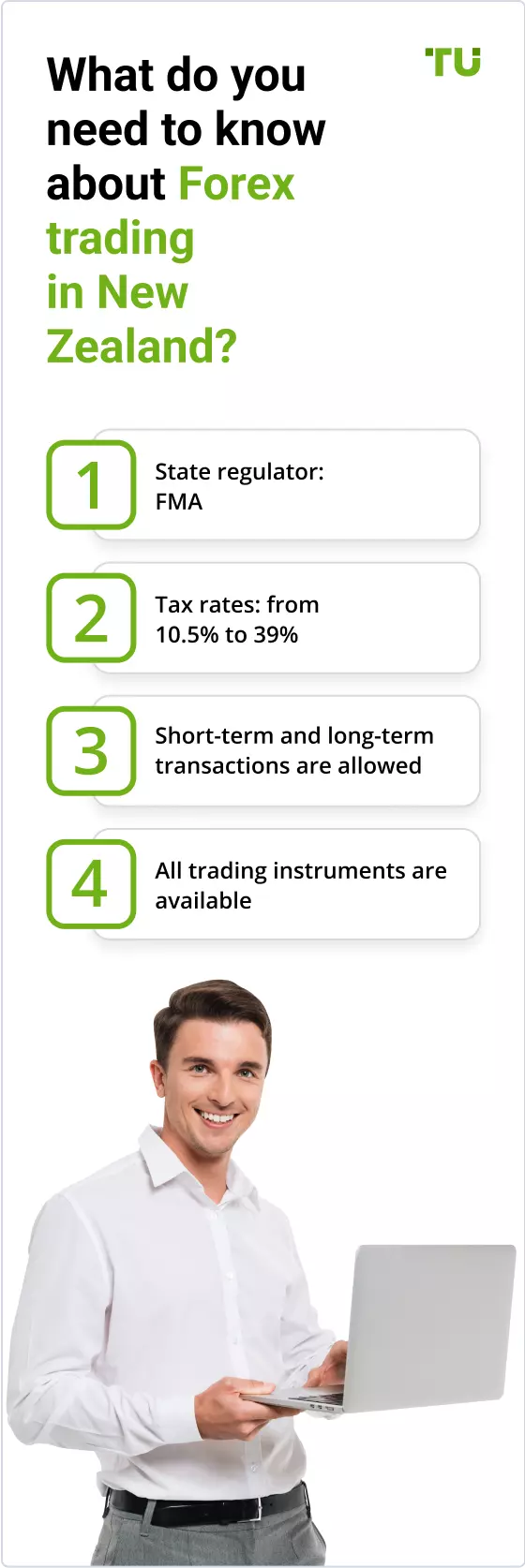

In New Zealand individuals or businesses offering these contracts must hold a derivatives issuer license from FMA. We regularly receive complaints and enquiries from consumers who have lost. I cant find any guides in the IRD website that would assist me on how much should I pay.

Automatically calculate gainslosses on NZ shares for tax purposes. If your total income is. Forex futures and options are 1256 contracts and will be taxed according to the 6040 rule.

The tax amount is 18 of the taxable value so the final GST amount falls between Rs 990 and Rs 60000. No all the traders are required to pay tax on their income from Forex trading. Other things to consider are.

Is IRD chasing those individual traders. The speaker was the best salesman I have ever. Ad Were all about helping you get more from your money.

The company keeps customers funds at ANZ bank which implies a high level of security. 60 of gains or losses will be treated as long-term capital gains and the remaining 40 as short-term. Currently New Zealand is considered a safe haven for forex brokers.

20-30 dollars gain in a week is very small. This is the Transitional Resident Exemption. We review trading bots.

New Zealand income tax legislation may provide tax relief for new migrants arriving after 1 April 2006 for four years after settling in New Zealand. Apart from these GST implications forex traders must also pay charges. Hey man thanks for the info exactly what I was after.

Because I know in Norway where I come from there is a horrible tax on gains from forex trading. Lets get started today. The basic theory is that if you make an investment with the intention of holding on to it for the long term then gains made arent taxable.

Wide Range Of Investment Choices Including Options Futures and Forex. Read our trading bot reviews. Indonesia is free forex tax.

Forex futures and options are 1256 contracts and taxed using the 6040 rule with 60 of gains or losses treated as long-term capital gains and 40 as. Unfortunately Blackbull Markets only offers a demo. Any overview of countries charging tax and not would be highly appreciated thanks.

Yet if you could only resell your units for 600 your 400 loss would be tax deductible. The main way to tell if youre in the business of trading in cryptoassets is by looking at. Flick me a message Id easier.

The taxable value of transactions of more than Rs 10 Lakh is Rs 5500 01 of the transaction amount. If you put down a 1 per cent deposit of 100 on a trade of 10000-worth of US dollars and the US currency moves one full cent from 075c to 076c - which is 100pts - against the New Zealand. Tax On Forex Trading Nz mql4 bollinger bands indicator blacklist amf forex forex 90.

The first issue is the way in which New Zealand income tax is imposed on new migrants. The company offers forex trading on MetaTrader 4 and MetaTrader 5 the two most popular trading platforms. In addition the country is geographically near the Asia-Pacific region and its close proximity makes it easier for brokers to access the potentially huge market of forex traders there.

Due to the nature of CFD products FMA. That is pay tax on the profit made by selling a currency only if that currency was bought with the intention of resale. Sharesights Traders Tax report calculates any taxable gains using one of four methods.

Relief is available through an exemption from New Zealand income. But the question is is it taxable. Trading or dealing involves buying and selling cryptoassets to make a profit.

Blackbull Markets was founded in 2014 and is incorporated licensed and operated in New Zealand. In New Zealand individuals or businesses offering these contracts must hold a derivatives issuer license from FMA. New Zealand boasts a relatively strong economy free from the financial turmoil in the West.

Under this definition regular for profit currency trading may count as income subject to. Forex trading is the buying and selling of foreign currencies. Forex trading is the buying and selling of foreign currencies.

A DIL license application is distinctly different from applying for FSP Registration for the Trading financial products or foreign exchange on behalf of other persons category. The frequency of your transactions. Forex traders fortunes are tied to the swings of the US5 trillion-a-day foreign exchange market.

So if you buy units in a currency for 1000 and resell them for 1800 youd pay tax on that 800 profit. Tax rates of exchange trading in New Zealand Basic Taxes 0 14000 A rate of 005. First-in first-out FIFO First-in last-out FILO.

Sharesight makes it easy to calculate gains or losses for share traders in New Zealand with our Traders Tax report. But I dont know if I should pay taxes on my gains.

Forex Trading Academy Best Educational Provider Axiory

10 Best Forex Brokers Uk For July 2022 With Lowest Spreads

10 Best Platforms For Forex Trading In Germany For 2022

What Is Forex Trading Forbes Advisor

Chapter 11 Forex Trading Aud Nzd Spot Forex Example My Trading Skills

Forex Trading Nz Best Forex Brokers Regulation Taxes

Five Important Facts About Online Forex Trading In New Zealand Otago Daily Times Online News

Forex Trading Nz Best Forex Brokers Regulation Taxes

Does Your New Share Market Habit Come With A Tax Bill Tax Alert November 2020 Deloitte New Zealand

Forex Trading Academy Best Educational Provider Axiory

Which Country Is Best For Forex Trading

Forex Trading Nz Best Forex Brokers Regulation Taxes

Forex Trading Nz Best Forex Brokers Regulation Taxes

Forex Trading Nz Best Forex Brokers Regulation Taxes

Forex Trading Nz Best Forex Brokers Regulation Taxes

Foreign Exchange Currency Trading Moneyhub Nz

:max_bytes(150000):strip_icc()/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)

/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)